In today’s fast-paced business environment, finance teams face mounting pressure to provide accurate, timely insights while managing increasing volumes of financial data. Leveraging Financial Statement Flux Analysis through AI and automation transforms how organizations monitor, interpret, and report changes in financial performance. Result Lane’s advanced platform combines intelligent analytics, automation, and cloud accessibility to streamline flux analysis, reduce errors, and provide actionable insights, enabling finance professionals to focus on strategic decision-making rather than manual reconciliations.

Understanding Financial Statement Flux Analysis

Financial statement flux analysis is the process of comparing financial data across multiple periods to identify and understand variances. Typically, this analysis focuses on changes in:

* Revenue and Sales Figures: Pinpointing fluctuations in income streams.

* Operating and Non-Operating Expenses: Tracking unexpected changes in costs.

* Balance Sheet Accounts: Analyzing shifts in assets, liabilities, and equity.

* Profitability Metrics: Understanding trends in net income or gross margins.

The goal is to explain the “why” behind variances rather than just presenting the “what.” Traditional methods often rely on spreadsheets, manual reconciliations, and human analysis, which can be time-consuming, error-prone, and limited in scope.

Challenges in Traditional Flux Analysis

Despite its importance, manual flux analysis comes with several challenges:

1. Time-Intensive Calculations: Consolidating data from multiple systems or subsidiaries often requires hours of manual effort.

2. Prone to Human Error: Manual entries and calculations increase the risk of inaccuracies.

3. Limited Analytical Insight: Basic spreadsheets may identify variances but rarely provide context or predictive insights.

4. Complex Data Integration: Organizations with multiple entities, currencies, or accounting standards face difficulties reconciling financial data.

5. Delayed Decision-Making: Slow reporting cycles can hinder management’s ability to respond to financial changes proactively.

These limitations underscore the need for AI-driven automation in financial flux analysis.

How AI Enhances Financial Statement Flux Analysis

AI transforms flux analysis by automating repetitive tasks, identifying anomalies, and providing predictive insights. Key improvements include:

1. Automated Data Consolidation

AI platforms like Result Lane automatically collect and consolidate financial data from multiple sources, ensuring accuracy and consistency. By eliminating manual entry, finance teams can significantly reduce errors and free up time for analysis.

2. Intelligent Variance Detection

AI algorithms can detect unexpected changes, trends, or anomalies across financial statements. This includes identifying unusual revenue fluctuations, cost overruns, or intercompany discrepancies, enabling finance teams to investigate and resolve issues quickly.

3. Predictive Analytics for Variance Explanation

Beyond identifying differences, AI can provide predictive insights into why variances occur. For example, machine learning models can correlate revenue fluctuations with seasonal trends, market conditions, or operational factors, helping finance teams explain changes to stakeholders with confidence.

4. Faster Close Cycles

Automation accelerates month-end, quarter-end, and year-end closing processes by streamlining reconciliation, variance calculation, and reporting. Faster close cycles enable management to access real-time insights and make informed strategic decisions more quickly.

5. Enhanced Audit Readiness

AI-powered platforms maintain comprehensive audit trails and detailed variance explanations. This ensures compliance with regulatory standards, simplifies audits, and provides transparency for internal and external stakeholders.

The Role of Automation in Flux Analysis

Automation complements AI by streamlining repetitive and labor-intensive tasks, allowing finance teams to focus on higher-value activities:

* Automatic Variance Calculations: Systems can calculate differences across multiple periods and accounts instantly.

* Threshold-Based Alerts: Automation can flag variances that exceed predefined limits, prompting timely investigation.

* Report Generation: Automatically produce standardized or customized reports for management, auditors, or regulators.

* Data Validation: Automated checks ensure consistency and accuracy, reducing the likelihood of reporting errors.

By combining AI with automation, finance teams can achieve faster, more accurate, and more insightful flux analysis.

Key Features of Result Lane’s Financial Statement Flux Analysis Tools

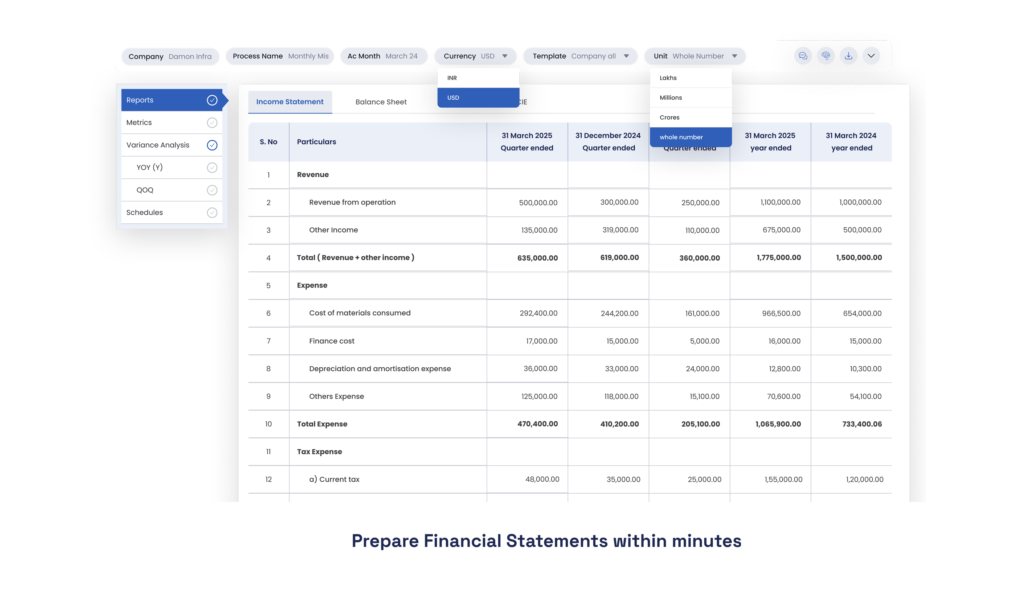

Result Lane’s platform is designed to empower finance teams with robust AI-driven and automated flux analysis capabilities. Notable features include:

* End-to-End Automation: Streamlines data collection, variance calculation, and report generation.

* AI-Powered Anomaly Detection: Identifies unusual fluctuations and highlights areas requiring review.

* Interactive Dashboards: Visualize trends, variances, and key metrics in real-time.

* Detailed Drill-Down: Trace variances from high-level summaries down to individual transactions.

* Customizable Alerts: Set thresholds and receive notifications for significant changes.

* Regulatory Compliance Support: Ensure reports meet IFRS, GAAP, and local statutory requirements.

These features allow finance teams to transform flux analysis from a manual, reactive task into a strategic, proactive function.

Benefits of AI-Driven Flux Analysis

Adopting AI and automation for financial statement flux analysis delivers measurable benefits:

1. Improved Accuracy: Reduces human errors in calculations and reconciliations.

2. Time Savings: Streamlined processes accelerate reporting cycles.

3. Actionable Insights: Provides context and predictive analysis for variances.

4. Enhanced Compliance: Maintains audit trails and ensures adherence to standards.

5. Strategic Decision-Making: Enables executives to act on real-time, reliable financial insights.

6. Scalability: Supports growing businesses with complex multi-entity or multinational structures.

Best Practices for Implementing AI and Automation in Flux Analysis

1. Integrate Systems: Ensure ERP, accounting, and reporting systems are connected for seamless data flow.

2. Define Materiality Thresholds: Focus on variances that have significant business impact.

3. Document Variance Explanations: Maintain detailed records to support audits and management review.

4. Regularly Monitor Reports: Perform flux analysis consistently to stay ahead of trends.

5. Train Finance Teams: Provide proper guidance on leveraging AI tools for maximum value.

Conclusion

Financial statement flux analysis is essential for understanding changes in financial performance, ensuring compliance, and supporting strategic decision-making. By leveraging AI and automation through Result Lane’s Financial Statement Flux Analysis platform, organizations can streamline data consolidation, detect anomalies, accelerate reporting, and gain actionable insights.

For CFOs, controllers, and finance professionals, integrating AI-driven flux analysis tools transforms a manual, labor-intensive process into a proactive, strategic function. This empowers finance teams to provide timely, accurate, and meaningful insights that drive better business decisions, enhance compliance, and support sustainable growth in today’s dynamic financial landscape.